UPI emerges as the second most preferred repayment method for digital loans: CASHe Report

CASHe releases its exclusive Financial Mood of the Millennials (FMOTM) 2022-23 Report

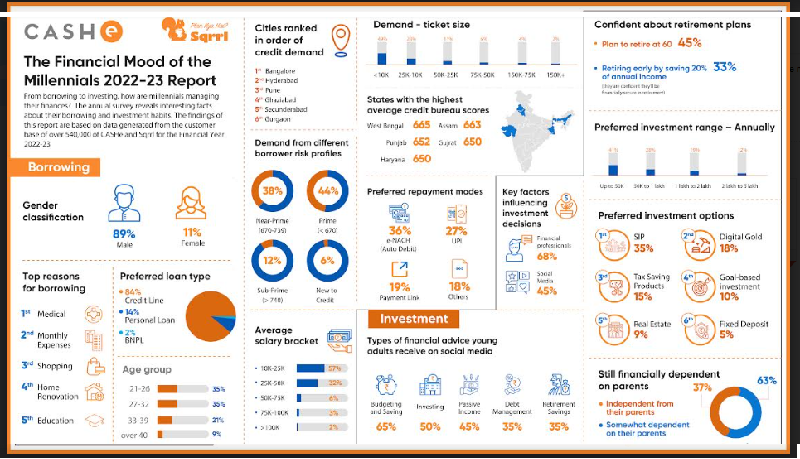

* 84% of millennials prefer credit lines over instant personal loans or BNPL.

* Medical bills and monthly expenses are the top reasons for borrowing.

*49% of millennials prefer small-ticket loans of less than Rs.10k

*Bangalore tops for credit demand among millennials

*UPI is the second most popular method to repay after e-NACH (auto-debits)

* SIP is the most popular investment option for millennials.

CASHe, India’s leading credit-led, AI-driven financial wellness platform, today released the Financial Mood of the Millennials 2022-23 report, an exclusive and proprietary analysis based on a pool of 540,000 customers. The report reveals unique and valuable insights into the millennials borrowing, spending, and

investing habits.

One of the top findings of the report is that 84% of its customers prefer to take a credit line over personal loans (14%) and BNPL (2%). Satchetised loans of less than Rs 10,000 are preferred by 49% of millennials. The data further indicates a significant credit demand from bureau-based prime (44%) and near-prime (38%) millennials, thereby reinforcing the need for unsecured and hassle-free digital credit products that are easily accessible by all.

Unforeseen medical and monthly expenses are the top two reasons for availing short-term digital credit followed by shopping, home renovation, education, etc. Bangalore leads all the cities in India for credit demand followed by Hyderabad, Pune, Ghaziabad, and Gurgaon. The data also throws up a surprising insight – West Bengal, Punjab,Gujarat, Assam, and Kerala represent the states from where millennials with the highest bureau scores have availed credit from CASHe. Incidentally, the customers chose UPI (27%) as the second most preferred repayment method after e-NACH (36%). 2022- 23 also saw an uptick of 1% in women borrowers compared to previous years.

The report also sheds interesting light on millennial investment habits using the customer base of its Sqrrl investment platform. It is observed in the report that 68% of millennials seek assistance from financial advisors for making investment decisions. Another 45% trust social media as a prime source to make investment decisions.

The report also states that about 37% of millennials are still somewhat financially dependent on their parents, but a majority of 63% of millennials are financially independent. SIP has emerged as the most popular option for online investors, accounting for 35% of their investing activities, interest in digital gold (18%) is beginning to catch up, followed by tax-saving products (15%), goal-based investments (10%), real- estate (9%), & fixed deposits (5%). There is a growing consciousness among millennials to start saving early for their post-retirement life. More than 33% of millennials stated they believe in saving 20% of their annual income to become financially secure for retirement.

Speaking on the release of the FMOTM, 2022-23 Report, Mr. V. Raman Kumar, Founder Chairman, CASHe, said, “The report offers unrivaled access to a large sample of data covering over 540,000 millennials – the insights provided here are valuable to policymakers, financial institutions, and researchers to better understand the borrowing, spending and saving habits of over 125 million credit-starved and underbanked urban mass of millennials. The India consumption story is defined by the credit and spending habits of this cohort. CASHe is committed to building its entire financial wellness business around catering to this cohort in order to create a financially inclusive Bharat in the coming years.”