India’s 36 Mn sq.ft. flexible space segment to grow by 10-15% (y-o-y) in the next three years

- CBRE shares outlook on the evolving Flex space segment from Occupiers, Landlords as well as Operators

- Fluidity of the workplace, portfolio agility, and hub & Spoke models to be the future growth drivers for the flexible space industry

- Tier 2 and 3 markets to witness an increase in flex demand owing to the increased focus on Distributed Working and Work from Anywhere models being adopted by enterprise clients in the near future

CBRE South Asia Pvt. Ltd, India’s leading real estate consulting firm, today announced the details of its report ‘The Future is Flex’ that highlights emerging trends and future expectations in India’s flexible space segment. On the back of the hybrid space demand, expansion across cities & sustained funding, CBRE expects India’s flexible stock to grow by 10-15% (y-o-y) from the current 36 Mn sq.ft in the next three years.

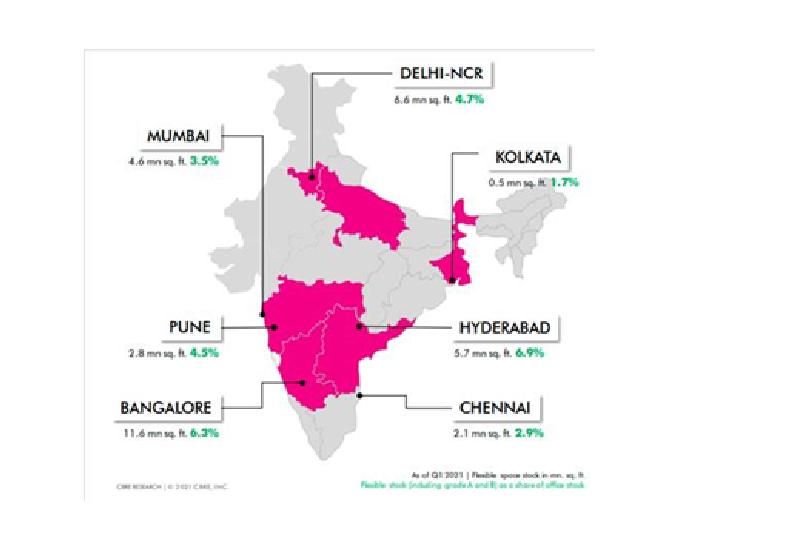

The report highlights that as of Q1,2021, Bangalore holds a Flex stock of 11.6 Mn sq. ft. which is the maximum in the country, followed by Delhi-NCR at 6.6 Mn sq. ft and Hyderbad at 5.7 Mn sq. ft. While these cities, along with Mumbai will continue to see further demand, Flex demand in cities like Pune and Chennai are also expected to see growth in the coming years. In 2020 alone, over 75,000 seats were leased in Flex spaces across India.

Additionally, with an expanded range of flexible space options, and increased focus on hybrid working models by enterprise clients, Tier 2 and 3 markets are also expected to witness an increase in Flex demand. Tier 2 activity is expected to be dominated mostly by domestic operators during the next couple of years.

The report deep dives into the stakeholders’ view on the flexible space segment along with highlighting the brand’s capabilities under advisory and transaction for all stakeholders. Below are some key highlights:

OPERATORS VIEW: Post the mass vaccination, Work from Anywhere (WFA) / hybrid working will be a big focus for most businesses. Operators performance will be based on the following:

- Sustained occupancies on the back of managed / ‘enterprise’ coworking/hybrid space demand

- Thoughtful network expansion across cities

- Sustained funding for financially sound players

In way forward, operators will prioritize expansion with a focus on efficiency:

- New arenas for sustenance and growth: Focus on improving tenant profile and profitability in operational centers through further amenitization, tech enhancement, and layout changes

- Higher focus on customized solutions: Emphasis on higher flexibility and innovative solutions/deal structures such as reverse officing, fit-outs as a service, pay-per-use models, all access products,etc. among others

- ‘Creative’ partnerships with landlords: Landlords would consider undertaking partnerships or management agreements with operators post the COVID-19 outbreak and are likely to be more open to structuring portfolio tie-ups

OCCUPIERS VIEW: In way forward, occupiers will focus on:

- PORTFOLIO ‘RE-OPTIMISATION’: Now integral to medium-to-long-term, cost-effective, and ‘core + flex’ strategies for inculcating Work From Anywhere (WFA) adoption if required

- LOCATION STRATEGIES: Possible dispersion towards multiple locations within/among cities via hub-and-spoke models in line with WFA

- AUGMENTED PREFERENCE TOWARDS AGILITY: Occupiers would display an increased inclination towards agility/flexibility to meet RE requirements

LANDLORDS VIEW: Landlords may consider getting into ‘strategic’ partnerships with operators or creating their own brands to cater to the demand for flex spaces in their portfolio

- HOTELISATION OF OFFICE SPACE: To improve their product offering, landlords may want flexible spaces as part of their buildings along with an increased focus on ‘amenitization’ for F&B, living/convenience, meetings/events, and wellness

- ‘CREATIVE’ PARTNERSHIPS WITH FLEX OPERATORS: Landlords partnerships or management agreements with operators may become more common in the post COVID-19 period/era. We may also witness portfolio tie ups between landlords operators going forward

- VALUATION OF OFFICE SPACE: Landlords may strive to find the optimum share of flexible spaces as part of their portfolios with an eye on valuations

Commenting on the announcement, Mr. Anshuman Magazine, Chairman, India & South-East Asia, Middle East & Africa, CBRE, said “The pandemic influenced the way businesses function, and their overall strategies. Businesses are evaluating new working models that keep workplace flexibility at the centre, balancing employee benefits and business profitability. These models will not only ensure flexible working, but also ensure employee safety once offices resume normal operations. The demand for physical office spaces will continue to rise as employee look forward to normal work days; with mass vaccination propelling further sectoral growth.”

Commenting on the same, Mr. Ram Chandani, Managing Director, Advisory & Transactions Services, India said, “We are witnessing an accelerated change in performance, expectations, and role of the workplace. Firms have been successful in changing their strategies to ensure seamless functioning, while effectively leveraging potential changes in work styles. While for many the work from home culture may continue, the demand for physical workspaces is expected to be driven by flex offerings.”

FUTURE GROWTH DRIVERS FOR THE FLEXIBLE SPACE INDUSTRY In India

FLUIDITY OF THE WORKFORCE To tackle the uncertainty of headcount projections/ Phased growth+ mobile teams/ Temporary workforce

- PORTFOLIO RE-OPTIMISATION In line with new ‘core+flex’ strategies and location agnosticism through WFA policies

- HUB-AND-SPOKE MODELS: For opening satellite offices/locations + reducing employee commute time

- ENHANCED FINANCIAL STRUCTURING: Risk mitigation via short-term stop-gap measures (including incubation spaces) + capital-light deal structures for medium-to-long-term savings

- INCREASED FLEXIBILITY OF DEAL STRUCTURES for portfolio agility via flexibility of deal structures

- RISING NUMBER OF ‘STRATEGIC’ PARTNERSHIPS / ACQUISITIONS between ‘investor – operator’ / ‘landlord – operator’/ ‘occupier – operator’

- CAUTIOUS EXPANSION BY OPERATORS: Further expansion by operators within tier I and towards tier-II cities in the medium to long term