GST reforms will continue; rates may come down further: PM Modi

Prime Minister Narendra Modi on Thursday hinted at further reforms in the Goods and Service Tax (GST) in a manner that will reduce the tax burden on businesses and consumers further, and give a fillip to the economy’s growth potential.

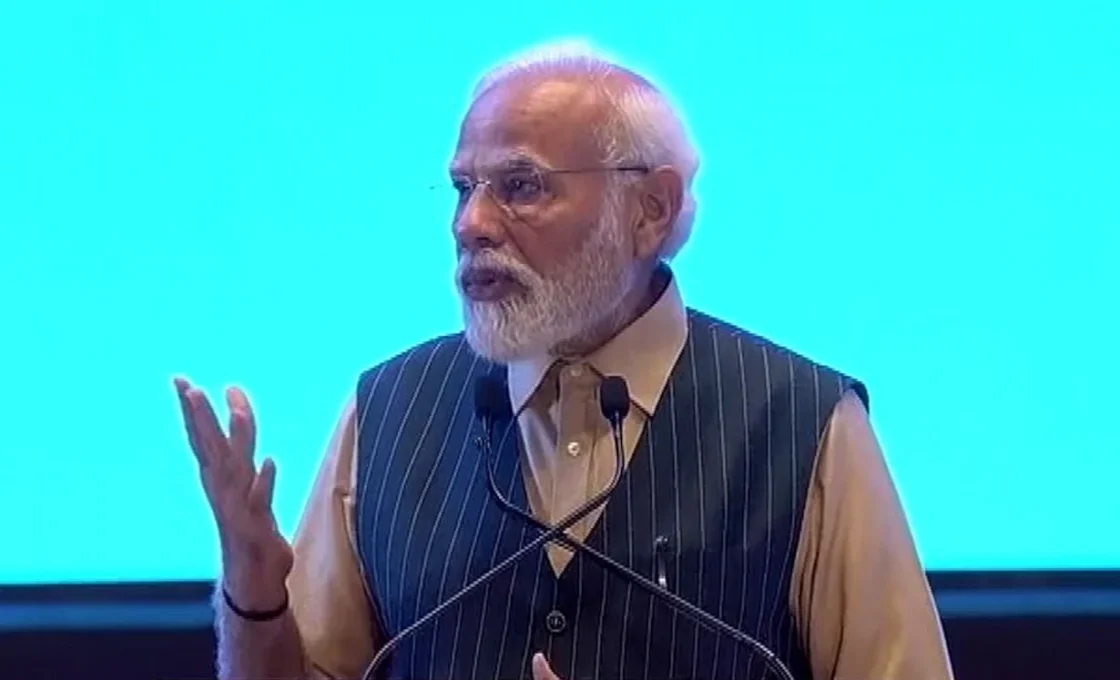

Addressing the gathering after inaugurating the Uttar Pradesh International Trade Show 2025 here, he said: “Today, the country is proudly celebrating ‘GST Bachat Utsav’. I want to tell you that we are not going to stop here. In 2017, we brought GST… and then again (brought reforms) in 2025. We will further strengthen the economy. As the economy continues to grow, the tax burden will continue to decrease. With the blessings of the citizens, the reforms in the GST will continue.”

The statement assumes significance as many experts, while welcoming the 2nd generation GST reforms (GST 2.0) unleashed by the GST Council recently, stressed the need for completing the process by broadening the tax base further with the inclusion of left-out items like auto fuels and real estate.

Many have advocated a single-slab GST, as it is reckoned to be the best way to eliminate the cascading of taxes.

With the recent changes in the GST structure, the destination-based consumption tax has essentially two rates – 5% for merit goods, and 18% as standard – as compared to four earlier.

These apart, there is of course the nil rate (exemption) and a 40% rate for a small number of sin goods. While the new structure is widely accepted to be superior to the earlier one, the possibility of accumulation of input tax credits with wide sections of the industry persists.