CONSOLIDATED RESULTS FOR QUARTER / YEAR ENDED 31ST MARCH, 2023

FY23 Highlights

Reliance Industries Limited

• Record performance led by rebound in O2C and continuing growth in consumer businesses

o Consolidated Revenue at ₹ 976,524 crore, up 23% YoY

o Consolidated EBITDA at ₹ 154,691 crore, up 23% YoY

o Net profit at ₹ 74,088 crore, up 14% YoY pre-exceptional, up 9.2% incl. exceptional gain in FY22

• EBITDA and Net Profit have doubled in last 5 years

• Highest ever O2C earnings (pre-SAED) with tight fuel markets offsetting weak downstream chemical markets.

o Favorable domestic demand environment – Oil demand up 12%, Polymers demand up 12%, Polyester demand up 14%

• Oil & Gas EBITDA at 8-year high with steady KG D6 production at ~19 MMSCMD

• Net Debt at ₹ 110,218 crore, well below annual EBITDA

• Consumer businesses EBITDA at ₹ 68,260 crore, up 30% YoY

o Digital Services segment EBITDA crossed ₹ 50,000 crore mark

• Retail Revenue up 30% YoY at ₹ 260,427 crore; EBITDA up 45% YoY at ₹ 17,974 crore with 70 bps margin improvement

o 64% growth in Retail footprint, Total store count at 18,040

• Digital Services Revenue up 20% YoY to ₹ 119,785 crore; EBITDA up 25% YoY to ₹ 50,286 crore

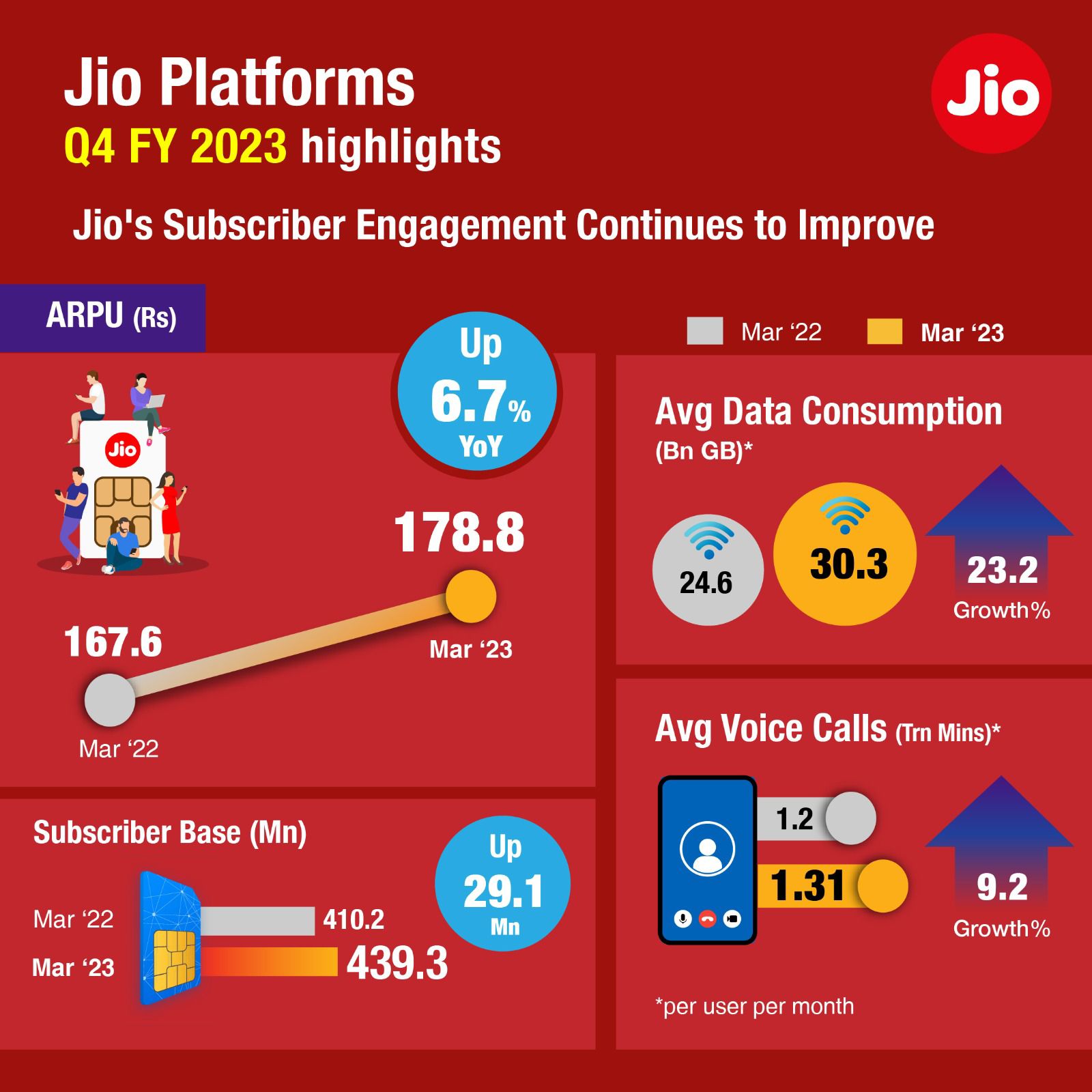

o ARPU at ₹ 178.8 for 4Q FY23, an increase of 6.7% YoY

o Subscriber base at 439.3 Mn, net add of 29 Mn subscribers

4Q FY23 RIL

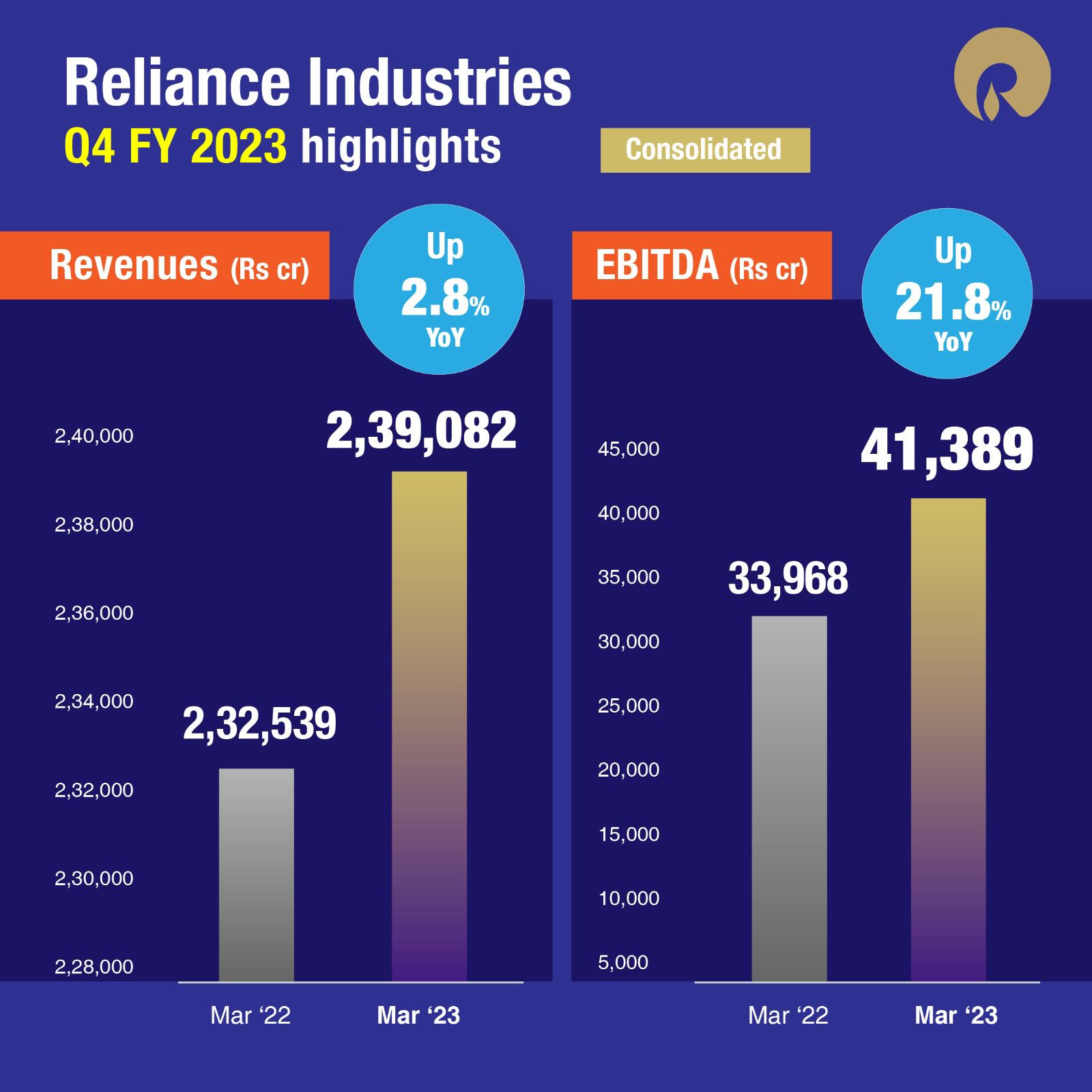

• Quarterly Revenue at ₹ 239,082 crore, up 2.8% YoY

• Quarterly EBITDA at ₹ 41,389 crore, up 21.9% YoY, driven by growth across all businesses

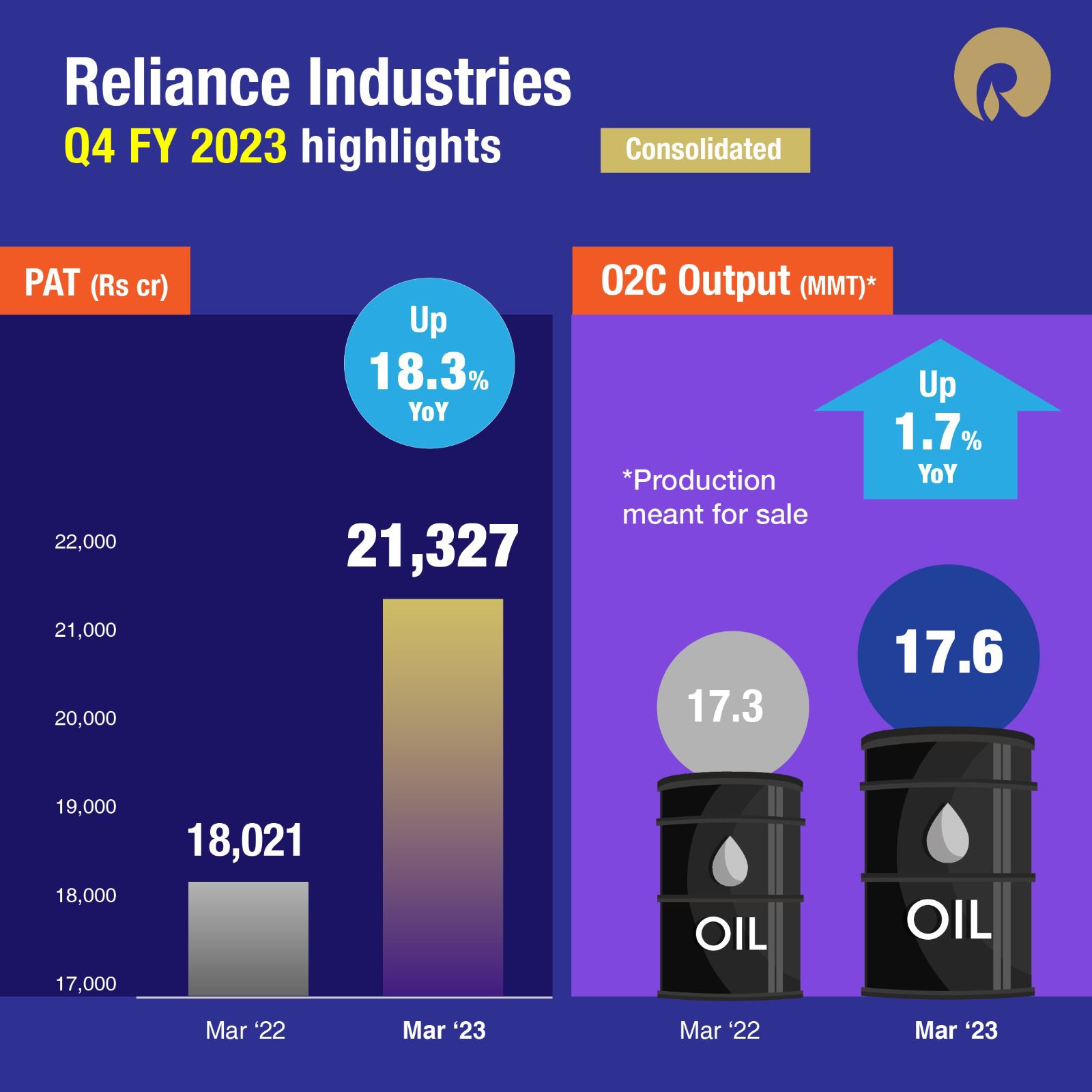

• Quarterly Net Profit at ₹ 21,327 crore, up 18.3% YoY with higher Finance cost and Depreciation partially offset by lower tax

FY23 Performance – O2C Business

• Revenue up 19% YoY to ₹ 594,649 crore with higher crude prices, average Brent prices up 19% YoY

• EBITDA up 18% YoY to ₹ 62,075 crore

o Reported EBITDA 10% lower due to SAED of ₹ 6,648 crore

o Strong global oil demand supported refining margins

o Weak global demand weighed on downstream chemical margins

o Sustained domestic demand and advantaged ethane cracking benefited RIL

• Production meant for sale at 66.4 MMT, down 2.6% Y-o-Y

• FY23 domestic oil demand up 12% Y-o-Y led by ATF (+47%), Gasoline (+13%) and Diesel (+12%)

• Strong average annual cracks at:

o Diesel cracks at $40.7 /bbl (v/s $12.3/bbl in FY22)

o Gasoline cracks $14.7 /bbl (v/s $11.4/bbl in FY22)

o ATF cracks $32.9 /bbl (v/s $9.1/bbl in FY22)

• Robust growth in domestic demand for downstream chemical products

o Polymer demand up 12% YoY

o Polyester demand up 14% Y-o-Y

• Weak margins for downstream chemical products

o Fall in polymer deltas by 15%-32% Y-o-Y with soft product prices

o Polyester chain deltas down 9% due to supply overhang

4QFY23 Performance – O2C

• O2C revenue down 11.8% Y-o-Y at ₹ 128,633 crore, with moderation of crude prices in 4Q

• EBITDA at ₹ 16,293 crore, with 14.4% Y-o-Y growth

o Performance impacted by SAED of ₹ 711 crore and weak PP and polyester margins

o Strength in middle distillate cracks and PX margins

o Competitive feedstock sourcing

o YoY PE delta up 5% and PVC up 7%, polyester chain delta down 8%

• QoQ EBITDA growth largely led by rebound in downstream chemicals and gasoline cracks

o Polymer margins up 4-25%, POY +29%, PET +42%

o Cracking economics aided by sharp decline (-36%) in US ethane prices

o Gasoline cracks up sharply to $ 15/bbl (vs. $ 5.1/bbl)

• Global oil demand at 100.4 mb/d, up 0.8 mb/d Y-o-Y

o Strong growth in Jet/Kero and gasoline demand offsetting lower gasoil demand due to mild winter.

• Domestic oil demand at 56.7 MMT, up 6% Y-o-Y

o Gasoline demand up 9.8% Y-o-Y with strong travel demand

o HSD demand up 6.7% Y-o-Y due to normalized economic activities

o Surge in domestic ATF demand by 38% Y-o-Y due to higher domestic as well as international traffic

• Polymer demand grew by 20% Y-o-Y led by PVC with strong demand from infrastructure, packaging, FMCG and farm sector

• Polyester demand grew by 9% Y-o-Y led by PET with pre-summer stock-up

FY23 Performance – Oil & Gas

• Robust growth in Revenues and EBITDA with increased production and higher gas prices

• Revenue at ₹ 16,508 crore, 2.2x times YoY, EBITDA at ₹ 13,589 crore, 2.5x times YoY

• Improvement in EBIDTA Margin at 82.3%, driven by higher realization

• Domestic Production at 10-year high

4QFY23 Performance – Oil & Gas

• Revenue at ₹ 4,556 crore, up 127% YoY, EBITDA at ₹ 3,801 crore, up 144% YoY

• Higher EBITDA margin driven by higher gas price and stable production

o KG D6 average production at 20 MMSCMD

o CBM average production at ~ 0.70 MMSCMD

Jio Platforms Limited

1. Annualized revenue run rate for JPL crossed Rs 1 lakh crore with revenue of Rs 25,465 crore in Q4FY23.

2. JPL’s Revenue and EBITDA in Q4FY23 continued to show strong ~14% and ~17% YoY growth, respectively.

3. Jio has clear leadership in 5G rollout with ~80% share of BTS deployment by the industry. Jio has deployed more than 125K 5G BTS in over 2,300 cities/ towns and is on track to complete pan India 5G rollout by December 2023. This would be the fastest ever 5G rollout for a country of our size, globally.

4. Jio leads the fixed broadband market as well with over 9 million connected premises. Quality of fixed broadband subscribers is also improving with > 90% of new connections being postpaid users.

5. During FY23, Jio has added over 29 million subscribers (net) which is well ahead of peers. Total subscriber base was 439.3 million as of March 2023.

6. Total data traffic on Jio network crossed 10 Exabytes per month and increased 23% YoY to 30.3 Exabytes during Q4FY23. Increased engagement levels and adoption of 5G/ FTTH would continue this uptrend.

7. JPL’s technology platform has powered unprecedented viewership of Indian Premiere League in 2023 with peak concurrency of 24 million and growing within the first 15 days of the season.

Reliance Retail Limited

1. The business recorded Gross Revenue of ₹260,364 crore for the year FY23, a growth of 30% over last year; delivers robust LFL growth across consumption baskets

2. The business posted an EBITDA of ₹ 17,928 crore, up 45% Y-o-Y. EBITDA Margin on net sales was at 7.8%, up +70 bps YoY.

3. EBITDA from operations was at ₹ 17,609 crore, up 61% Y-o-Y. EBITDA Margin on net sales was at 7.6%, up +140 bps YoY driven by favorable mix, sourcing benefits and operating efficiencies.

4. Reliance Retail expanded its physical store network with over 3,300 new store openings having an area of 25 million sq. ft, taking the total store count at the end of the year to 18,040 stores with an area of 65.6 million sq. ft.

5. Rapid scale-up of supply chain infrastructure with an addition of 12.6 million sq. ft. of warehouse space during the year. Total area now at 35.3 million sq. ft.

6. Reliance Retail continues to serve customers at scale

o Registered customer base grew 29% Y-o-Y to reach 249 million

o Crossed a milestone of 1 billion transactions, up 42% Y-o-Y, a testament of consumer trust on Reliance Retail’s value proposition

o Stores recorded footfalls of over 780 million, which were up 50% YoY

7. Sustained growth in Digital commerce and New commerce businesses with share of 18% of revenues; New commerce crosses a milestone of 3 million merchant partners; up 45% YoY

8. The business continues to innovate, launch and scale up new retail formats to serve diverse customer segments. The year witnessed number of such new format launches including Smart Bazaar, Azorte, Centro, Fashion Factory and Portico.

9. The business added new growth initiatives to its portfolio by foraying into FMCG and Beauty businesses. The FMCG business launched several products during the year including ‘Independence’ brand and the iconic beverage brand, ‘Campa’ while the beauty business launched digital commerce platform ‘Tira’ and opened its flagship store in Mumbai.

10. The business strengthened capabilities with acquisitions and partnerships, notable ones being Metro, GAP, Catwalk, Centro Footwear, Insight Cosmetics, Sunglass Hut, Tods, Pret a Manger, Sosyo, Lotus chocolates, Campa.

4Q FY23 – Key Messages

1. Reliance Retail continues with its growth momentum and posts Gross Revenue for 4Q FY23 at ₹ 69,267 crore, a 19% increase Y-o-Y

2. Business delivers steady growth across consumption baskets:

o Grocery business grows 66% YoY

o Fashion and Lifestyle grows 19% YoY

o Consumer Electronics excluding devices grows 37%

3. The business posted an EBITDA of ₹ 4,914 crore, up 33% Y-o-Y. EBITDA Margin on net sales was at 8%, up +70 bps YoY.

4. EBITDA from operations was at ₹ 4,769 crore, up 33% Y-o-Y. EBITDA Margin on net sales was at 7.7%, up +60 bps YoY led by operating efficiencies and scale.

5. Reliance Retail expanded its physical store network with 966 new store openings having an area of ~6 million sq ft.

6. The business continued to invest in strengthening its supply chain capabilities by expanding over 1.7 million Sq. ft. of warehouse space

7. Reliance Retail received a record 219 million footfalls across formats and geographies in the quarter.

8. Digital and New Commerce continued to grow and contributed to 17% of revenue,

o Daily digital commerce orders up 17% Y-o-Y

o Merchant partners up 45% Y-o-Y across geographies and consumption baskets

Overall, the results reflect sustained growth momentum across consumption baskets with resilient profit delivery.